Brief History of Economics

By John P. Reisman in 2006; updated in 2021

Understanding the history of economics enables valuable perspective on the nature and methods used in economic reality.

It is worthy to note that economics is not merely a monetary function, which seems to be the way most view it. Economy by definition encompasses management of affairs and expenses, thrifty use of material resources, and efficiency.

Barter was a relatively inefficient method of trade, which led to facilitating trade by other means. Value based currency, or fiat. Development efficiency was tied to a more flexible system than direct barter.

Most notably, the definition of economics includes the mode of operation of something and systems of interaction and exchange. By extrapolation we can see that economy deals with how things interact. This includes money and material.

Human Material Development & Productivity

In the context of human exploitation of resources, which is the basis of human material productivity, our understanding of economy, in order to be complete, must include global resource capacity, and rate of human consumption of those resources along with our monetary economy and well being of our human society.

Only in a complete consideration of all economies of material wealth of earths resources and human capacities can we begin to understand what a healthy economy might actually be.

Websters Definition

http://www.merriam-webster.com/dictionary/economy

- Main Entry:

- 1econ·o·my

- Pronunciation:

- \i-ˈkä-nə-mē, ə-, ē-\

- Function:

- noun

- Inflected Form(s):

- plural econ·o·mies

- Etymology:

- Middle French yconomie, from Medieval Latin oeconomia, from Greek oikonomia, from oikonomos household manager, from oikos house + nemein to manage — more at vicinity, nimble

- Date:

- 15th century

- 1archaic : the management of household or private affairs and especially expenses

- 2 a: thrifty and efficient use of material resources : frugality in expenditures ; also : an instance or a means of economizing : saving b: efficient and concise use of nonmaterial resources (as effort, language, or motion)

- 3 a: the arrangement or mode of operation of something : organization b: a system especially of interaction and exchange <an economy of information>

- 4: the structure or conditions of economic life in a country, area, or period ; also : an economic system

Economic Theory & Some History

Keep in mind that economic theories are more of a guide than a rule. While used to guide policy and principle, natural tendencies of systems are influenced by human factors and interventions, whether it be state, social or market manipulation that falls outside the boundaries of “fair trade of goods and services”. In reality, economies will go to any extent granted, or taken, to gain wealth or advance value.

We do not live in an ideal world although we hope that the principles of fair trade and balance will become endemic in order to level the playing field in achieving better quality of life based on earning and value.

A Brief History of Economics

The truth is if you think about economics as the balance of systems and methods and trade. Knowing when trade and accounting dates back to when accounting began. Maybe 8,500 years ago. While if may predate this time, we do know that agriculture and grain storage required accounting and the abacus was invented around that time.

Trade routes by land of see are documented now up to 12 to 14,000 years ago. So some form of economy via trade was functioning.

However, modern economics are typically attributed to British free trade and the development of classical economics.

The economy of trade has always included reaching out to the extent of ones ability to conduct commerce. History has indicated examples of sea trade predating the agricultural revolution. Trade it seems has been a long time motivator to expand horizons.

Commerce on the Rhine

But there is an interesting story that developed around the 12th century. But it’s origin story seems to go back to the beginning of the Roman Republic. 2,500 years ago. In the modern Basel region there is a Roman city called Agusta Raurica, dating back to the beginning of the Roman Empire. They established trade on and along the Rhine river. As the centuries rolled into the past, more modern developments occurred in the region.

Basel Stadt

Then, in the 1400’s, from a position of secretary to the Bishop of Fermo, Aeneas Sylvius Piccolomini took orders and eventually became pope Pius II. And soon after was a founding member of Switzerland’s first University, The University of Basel (Est. 1460).

This was created a different type of establishment. The indications show that Basel had formed a different way of governance in relation to the church and the laws of the region. This deal seemed to balance the power of the church with the government and the law. As such, this enabled a new form of economic development.

The marriage seems to have worked out well. In Basel the church worked alongside government and local law. Of course the road was still rocky as in all relationships. And it may be that this was, more or less, a new birth in the development of modern economics. Basel was a major trading port on the Rhine and highly influential. One of the first paper mills in Europe is in Basel (est. 1453).

I might not be an accident that The Bank For International Settlements (BIS) was established in Basel. And, what is known as the Basel Convention, which sets the tone for World Banks and Governments around the world. The BIS also does risk assessment for the global economy in its annual report released typically in July.

Free Market (late medieval and early-modern Europe)

A free market describes a theoretical, idealized, or actual market where the price of an item is arranged by the mutual non-coerced consent of sellers and buyers. Additionally the supply and demand of that item is not being regulated by a government (see supply and demand). The opposite is a controlled market, where government sets or regulates price directly or through regulating supply and/or demand.

However, while a free market necessitates that government does not regulate supply, demand, and prices, it also requires traders do not coerce or mislead each other. Thus, all trades are morally voluntary. This is not to be confused with a perfect market where individuals have perfect information and there is perfect competition.

The Ideal is Not the Norm

Somewhat idealistic in its concept, a free market assumes that participants do not mislead or coerce aspects of the market price, supply, and demand. And do not participate in price fixing, and do not mislead investors. In actual practice history has repeatedly shown that this ideal world does not exist, price fixing is still practiced and all market aspects are manipulated by coercion. This occurs in the political arena as well as the marketing to investors and the recipients of goods and services.

The precept of the free market is that government does not regulate, supply, demand or prices. With special interests paying for political campaigns it is obvious that this ideal is confounded by market realities and the natural tendency or desire for wealth and power.

Mercantilism (16th – 18th century)

Mercantilism is an economic theory that holds that the prosperity of a nation depends upon its supply of capital. And that the global volume of trade is “unchangeable”. Economic assets, or capital, are represented by bullion (gold, silver, and trade value) held by the state. Which is best increased through a positive balance of trade with other nations (exports minus imports). Mercantilism suggests the ruling government should advance goals by playing a protectionist role in the economy. By encouraging exports and discouraging imports, especially through the use of tariffs. The economic policy based upon these ideas is often called the mercantile system.

Classical Economics (1776)

Classical economics is widely regarded as the first modern school of economic thought. Its major developers include Adam Smith, David Ricardo, Thomas Malthus and John Stuart Mill. Sometimes the definition of classical economics is expanded to include William Petty, Johann Heinrich von Thünen, and Karl Marx.

The publication of Adam Smith’s The Wealth of Nations in 1776 is usually considered to mark the beginning of classical economics. The school was active into the mid 19th century and was followed by neoclassical economics in Britain beginning around 1870.

Classical economists attempted and partially succeeded to explain growth and development. They produced their “magnificent dynamics” during a period in which capitalism was emerging from a past feudal society. And in which the industrial revolution was leading to vast changes in society. These changes also raised the question of how a society could be organized around a system in which every individual sought his or her own (monetary) gain.

Class-based Interest

Classical economists reoriented economics away from an analysis of the ruler’s personal interests to a class-based interest. Physiocrat Francois Quesnay and Adam Smith, for example, identified the wealth of a nation with the yearly national income, instead of the king’s treasury. Smith saw this income as produced by labor applied to land and capital equipment. Once land and capital equipment are appropriated by individuals, the national income is divided up between laborers, landlords, and capitalists in the form of wages, rent, and interest.

Laissez-faire Economics (19th century – 1867 treaty marked use)

Laissez-faire is a French phrase meaning “let it be” (literally,”Let do”). From the French diction first used by the 18th century physiocrats as an injunction against government interference with trade, it became used as a synonym for strict free market economics during the early and mid-19th century.

It is generally understood to be a doctrine that maintains that private initiative and production are best allowed to roam free. This opposes economic interventionism and taxation by the state beyond that which is perceived to be necessary to maintain individual liberty, peace, security, and property rights. Free-market anarchists take the idea to its full length by opposing all taxation.

The Anarchist System

In the laissez-faire view, State has no responsibility to engage in positive intervention to force equal wealth distribution. Or to create a welfare state to protect people from poverty, instead relying on charity.

Laissez-faire also embodies free trade. Namely that a State should not use protectionist measures, such as tariffs and subsidies. This is in order to curtail trade through national frontiers. It also contains the idea that the government should not create legal monopolies or use force to damage de facto monopolies.

In the early stages of European and American economic theory, laissez-faire economic policy was contrasted with mercantilist economic policy, which had been the dominant system of the United Kingdom, Spain, France and other European countries, during their rise to power.

“Let do, let pass”

The term laissez-faire is often used interchangeably with the term “free market”. Some use the term laissez-faire to refer to “let do, let pass” attitude for matters outside of economics.

Laissez-faire is associated with classical liberalism, libertarianism, and Objectivism. It was originally introduced in the English-language world in 1774, by George Whatley, in the book Principles of Trade, which was co-authored with Benjamin Franklin. Classical economists, such as Thomas Malthus, Adam Smith and David Ricardo did not use the term—Bentham did, but only with the advent of the Anti-Corn Law League did the term receive much of its (English) meaning.

Austrian Economics (1871)

Austrian Economics (founded by Carl Menger) otherwise known as “The Austrian School”, “Vienna School” or the “Psychological School”. This is a school of economic thought deriving from an Aristotelian/rationalist approach. Which is assumed to derive from basic principles of human nature and action.

This Aristotelian/rationalist approach differs both from the currently dominant Platonic/positivist approach of contemporary neo-classical economics. Also differing from the once dominant historical approach of the German historical school and the American institutionalists.

A student of Austrian Economics and Eugen von Böhm-Bawerk was Ludwig von Mises. George Reisman, author of “The Government against the Economy” and “Capitalism” (wherein he endeavored to reconcile Keynesean and Austrian economics) was mentored by Mises.

The Self-Regulation Concept

Along the lines of thought within this economic theory, Mises felt that the market would self regulate if given free reign. In many ways he was correct but some points seem to be missing. The model does not consider mainly the immediate needs and desires of the businesses and the people without due consideration of long term needs. All in all the theory is strong but fails to serve the people when weighed with long term need. This is mainly due to the lack of foresight that desire tends to engender.

In “Interventionism, An Economic Analysis” (1940), Ludwig von Mises wrote:

The usual terminology of political language is stupid. What is ‘left’ and what is ‘right’? Why should Hitler be ‘right’ and Stalin, his temporary friend, be ‘left’? Who is ‘reactionary’ and who is ‘progressive’? Reaction against an unwise policy is not to be condemned. And progress towards chaos is not to be commended.

Nothing should find acceptance just because it is new, radical, and fashionable. ‘Orthodoxy’ is not an evil if the doctrine on which the ‘orthodox’ stand is sound. Who is anti-labor, those who want to lower labor to the Russian level, or those who want for labor the capitalistic standard of the United States? Who is ‘nationalist,’ those who want to bring their nation under the heel of the Nazis, or those who want to preserve its independence?

Neoclassical Economics (1871-1877)

Neoclassical economics. A general approach in economics focusing on the determination of prices, outputs, and income distributions in markets through supply and demand. These are mediated through a hypothesized maximization of income-constrained utility by individuals and of cost-constrained profits of firms employing available information and factors of production.

Mainstream economics is largely neoclassical in its assumptions, at least at the microeconomic level. There have been many critiques of neoclassical economics, often incorporated into newer versions of neoclassical theory as human awareness about economic criteria change. Neoclassical economics is often called the marginalist school.

Keynesean Economics (1921-1936)

Keynesian economics promotes an economy where the state and the private sectors play an important role. The theory promotes the idea that demand for goods is the driving factor of the economy. This theory, which happens to be the main economic theory of our current economy concludes that there is no impetus to achieve full employment or drive output and that the State and private businesses must work toward driving policies to encourage such ends. This seems to be in contrast to the tenets of classical and supply-side economics as well as the Austrian School.

http://en.wikipedia.org/wiki/John_Maynard_Keynes

Criticism

The Failure of the “New Economics” (1959) is a book by Henry Hazlitt offering a detailed critique of John Maynard Keynes’s work The General Theory of Employment, Interest and Money (1936).

Bettina Bien Greaves, in A Man for All Seasons says:

In Economics in One Lesson, Hazlitt demolished various Keynesian programs in a rather low-key manner. Then in 1959, in The Failure of the “New Economics,” he critiqued Keynes’ major work, The General Theory of Employment Interest and Money (1936) in detail, citing chapter and verse. The Failure of the “New Economics” (1959) is much more scholarly than Economics in One Lesson, its market narrower, but it is by no means less important.

To refute each Keynesian error, Hazlitt expounded sound economic theory in a way academia couldn’t ignore. John Chamberlain, who reviewed the book in The Freeman, titles his review “They’ll Never Hear The End of It.” The dean of the Department of Economics at a leading university questioned Hazlitt’s credentials for critiquing the noted Keynes. Mises came to Hazlitt’s defense. Hazlitt, Mises responded, was “one of the outstanding economists of our age,” and his anti-Keynes book was “a devastating critique” of the Keynesian doctrines.

Critics of Hazlitt have asserted that he repeatedly fails to understand Keynes properly and also never possessed sufficient mathematical ability to critique Keynes.

Full text available on mises.org

Demand-Side Economics

(See Keynesean Economics above)

Supply-Side Economics (1975)

Supply-side economics is a school of macroeconomic thought that argues economic growth can be effectively managed. By using incentives for people to produce (supply) goods and services such as adjusting income tax and capital gains tax rates. This can be contrasted with the classic Keynesian economics or demand side economics, which argues growth can be most effectively managed by controlling total demand for goods and services. Typically by adjusting the level of Government spending. Supply-side economics is often conflated with trickle-down economics.

The term was coined by journalist Jude Wanniski in 1975, and further popularised by the ideas of economists Robert Mundell and Arthur Laffer. Supply-side economics is controversial because its typical recommendation, reduction of the higher marginal tax rates, offers benefits to the wealthy, which commentators such as Paul Krugman see as politically rather than economically motivated.

Artificial Inflation

This may have marked the beginning of the advancement of artificial inflation. By placing incentives to produce (supply) goods and services into the market, a host of things were inspired to change. Legislative manipulation and even the production of things that were not needed can easily spawn from such an idea. If the idea was introduced in 1975 and took a little while to catch hold it may not be unreasonable to assume that this policy direction may have led to or be a principle factor in the legislative changes that have enabled the conditions described above.

Graph of Constant Dollar Incomes from IRS report (Link to Source)

This dramatic change in incomes in the upper class was not shared even in the upper middle class and negligible to null in the middle and lower income class segments.

Reaganomics (1981)

Reaganomics: A portmanteau of “Reagan” and “economics,” coined by radio broadcaster Paul Harvey. It is a term that has been used to both describe and decry free market advocacy economic policies of U.S. President Ronald Reagan. Reagan served as President from 1981 to 1989. A term, parallel in use, is Thatcherism, which refers to the economic philosophy of British Prime Minister Margaret Thatcher (1979–1990), who was Reagan’s contemporary. Reaganomics is most closely associated with neoliberal economic thought.

Trickle-down Economics (1981)

“Trickle-down economics” and “trickle-down theory,” in political rhetoric, are characterizations by opponents of the policy of lowering taxes on high incomes and business activity.

Proponents of these policies claim they will promote new investment and economic growth. Thereby indirectly benefiting people who do not directly pay the taxes. Opponents characterize this as a claim that the people who would otherwise pay the tax will distribute their benefit to less wealthy individuals. So that a fraction will reach the general population and stimulate the economy. Proponents of the policies generally do not use the terms “trickle-down economics” themselves.

Today “trickle-down economics” is most closely identified with the economic policies of the Ronald Reagan administration, known as Reaganomics or supply-side economics.

A major feature of these policies was the reduction of tax rates on capital gains, corporate income, and higher individual incomes, along with the reduction or elimination of various excise taxes. David Stockman, who as Reagan’s budget director championed these cuts but then became skeptical of them, told journalist William Greider that the term “supply-side economics” was used to promote a trickle-down idea.

The term “trickle-down” comes from an analogy with a phenomenon in marketing, the trickle-down effect.

Natural Capitalism (1990’s)

Natural capitalism is a set of trends and economic reforms to reward energy and material efficiency and remove professional standards and accounting conventions that prevent such efficiencies. It emerged in the 1990s as a coherent theory of how to exploit market systems and mechanisms of neoclassical economics to save energy, discourage waste, mimic ecology (biomimicry), and in general to support the goals of environmentalism by reframing commodity and product relations towards a strictly service economy, thereby extending the services of natural capital.

When capitalized, the term Natural Capitalism usually refers to the specific set of reforms described in 1999 by Paul Hawken, Amory Lovins, and Hunter Lovins in the book of the same name. There is a well-developed theory of natural capital that predates this work and some generic use of the phrase to apply to environmental economics. The book and additional material are available online at the book’s promotion site: http://www.natcap.org/

A related, sometimes overlapping, movement believes that networks are inefficient ways to provide services and advocates autonomous buildings.

DEFINITIONS

Planned (Command) Economy

A planned economy (also known as a command economy or centrally planned economy) is an economic system in which the state or government controls the factors of production and makes all decisions about their use and about the distribution of income. In such an economy, the planners decide what should be produced and direct enterprises to produce those goods.

Planned economies are in contrast to unplanned economies, i.e. a market economy, where production, distribution, and pricing decisions are made by the private owners of the factors of production based upon their own interests rather than upon furthering some overarching macroeconomic plan.

Market Economy

A market economy (aka. free market economy or free enterprise economy) is an economic system in which the production and distribution of goods and services take place through the mechanism unconstrained markets. Businesses and consumers decide what they will produce and purchase; how much to produce, what to charge goods and services, what to pay employees, etc. In the ideal market economy the government does not constrain the market. Price and production are naturally regulated by supply, demand and competition.

Generally, all economies are mixed economies combining varying degrees of market and command economy traits. For example, in the United States there are more market economy traits than in Western European countries.

Mixed Economy

A mixed economy Typically contains a mix of economic systems, both private-owned and state-owned enterprises or combined elements of competing economic theories.

Relevant aspects might include: various degrees of private economic freedom (including privately owned industry) intermingled with centralized economic planning (which may include intervention for environmentalism and social welfare, or state ownership of some of means of production).

Current Economics

Population growth increases resource consumption. Earth as of 2021 has over 7.6 billion people living on it. And still growing.

A multitutde of factors are in play. Growth, reliance on future proftis and growth to pay past debt. This occuring while resoruce capaicty is becoming more challanging including debt load imbalalnces to GDP and climate interferaring in food and ifrastructure costs.

To paraphrase the Taco Bell dog from an old ad, ‘We’re gonna need a bigger box.’

Unite America with The Centrist Party

- Enough is enough. We must unite to reclaim our government. Join the Centrist Party. Work together to heal our nation and return balance in governance and common sense for the nation and the people.

The Centrist News

Check out Centrist News & Perspectives for centrist media intelligence:

CP Voter Guide: 2024 – This election is a choice between everything America has stood for, or Trump

by John Reisman | Sep 2, 2024 | Economic Security, Economy, Education, Election, Election, Election, Energy, Environment, Environment-Global Warming, Healthcare, Healthcare Politics, Healthcare Security, Int'l, NATSEC, Political Economics, Political Reform, Political Sophistry, Politics, Politics Election Fraud, Politics Election Security, Security, Security

Be careful what you don't vote for? You might get what you don't want!This article will be updated as more information is weighed.Updated: Nov. 1, 2024 See Also: Trumps Terror Tactics are Starting to Work as Companies and News Orgs Decline to Endorse If They Look,...

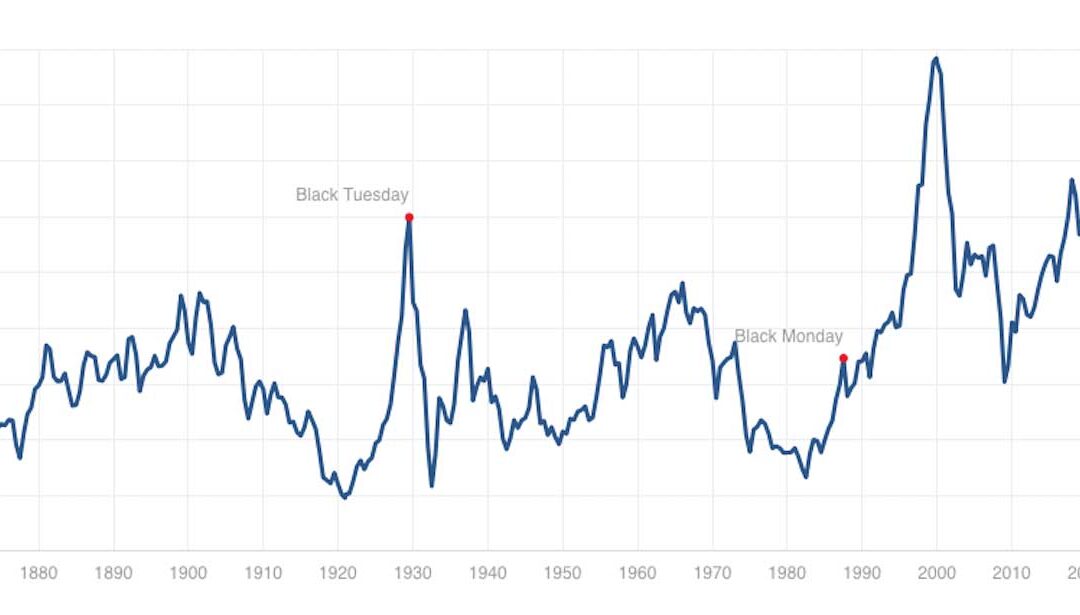

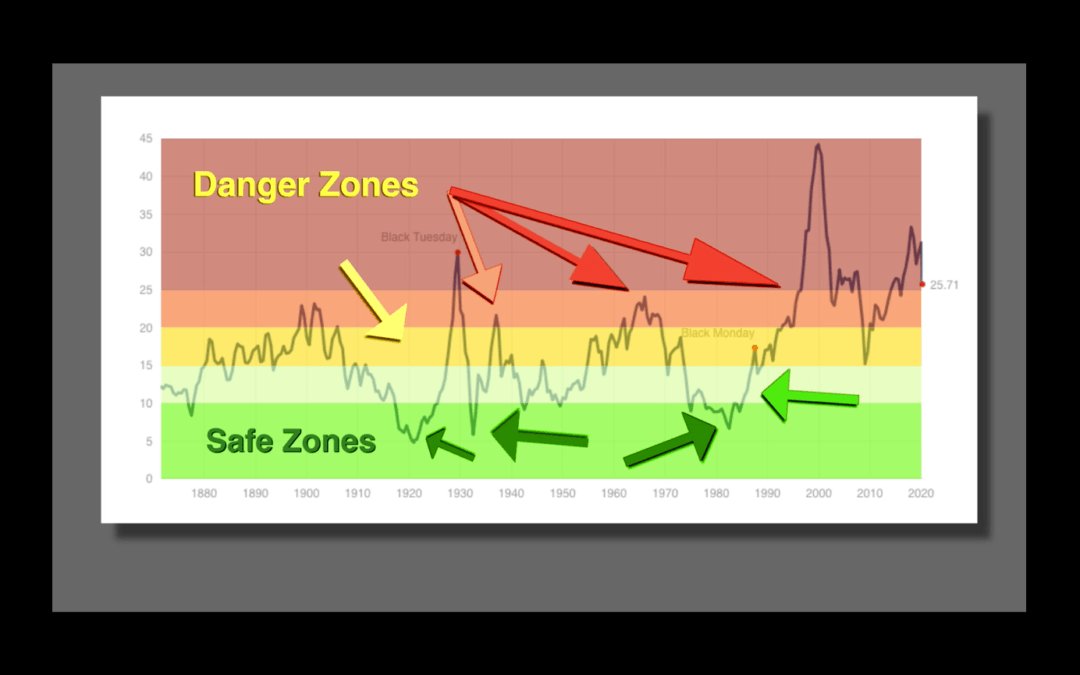

Challenging, Difficult & Dangerous: The Shiller P/E

by John P. Reisman | Nov 3, 2021 | Economic Security, Economy

The Shiller P/E Ratio Near 40 The Shiller P/E ratio has only been this high on three other occasions. The 1929 market crash, which resulted from an overly exuberant market. The 2000 bubble and crash, which resulted from an overly exuberant market. And now, during a...

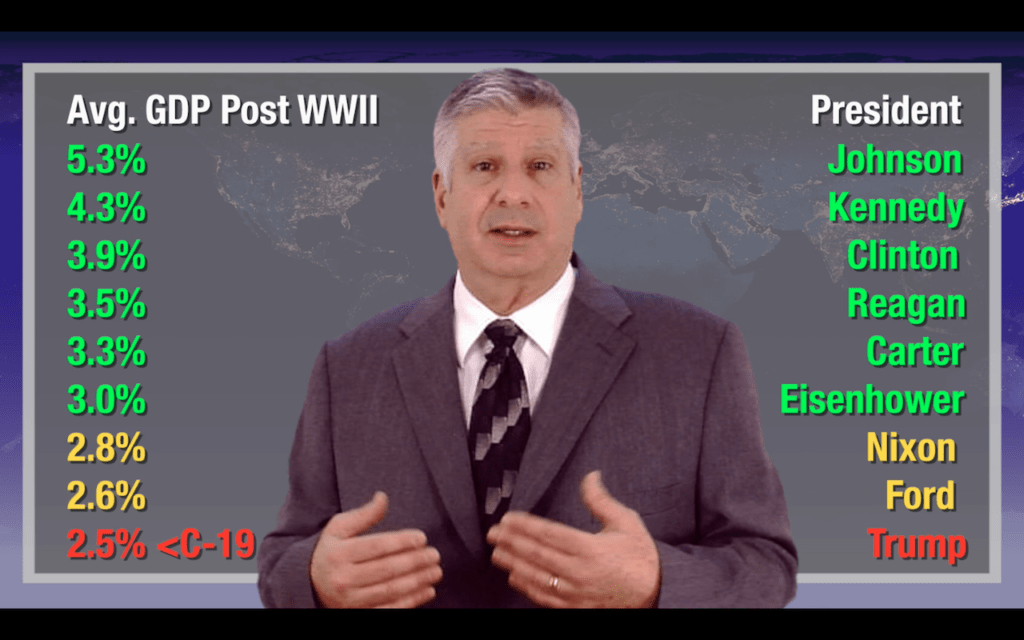

Fact Check On Trumps NOT The Greatest Economy

by John P. Reisman | Oct 28, 2020 | Economic Sophistry, Economy

Simply put, without going into the whole history of US economics, since Truman, Johnson, Kennedy, Clinton Reagan, Carter, Eisenhower, Nixon & Ford all had higher GDP performance that Donald Trump. And that’s only eight that did better than Donald. If you go back further, Donny gets pushed even further down the list. So, no Trump did not produce the greatest economy and yes, he continues to lie to his supporters about it.

Trump vs Shiller – Let’s Get Ready To Rumbleeee…

by John P. Reisman | Mar 22, 2020 | Economy

Trump cheated America into a Fake Market that put the country into a higher risk position. To make himself look better he forced higher levels of artificial inflation into the market just so he could brag that he was able to make the market go up by giving tax breaks and lowering interest rates. Now America is forced to pay the price for Trumps ego.

#News, #Economy, #Security, #Trump

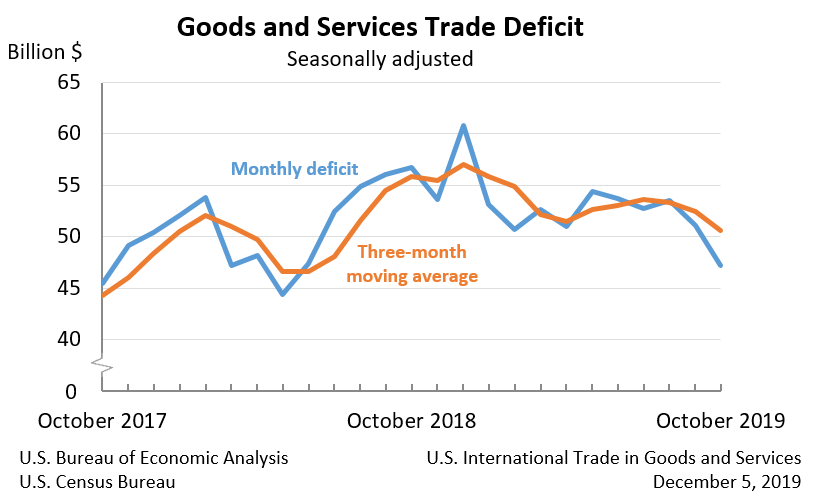

The Trump Trade: How much damage is the trade war really causing?

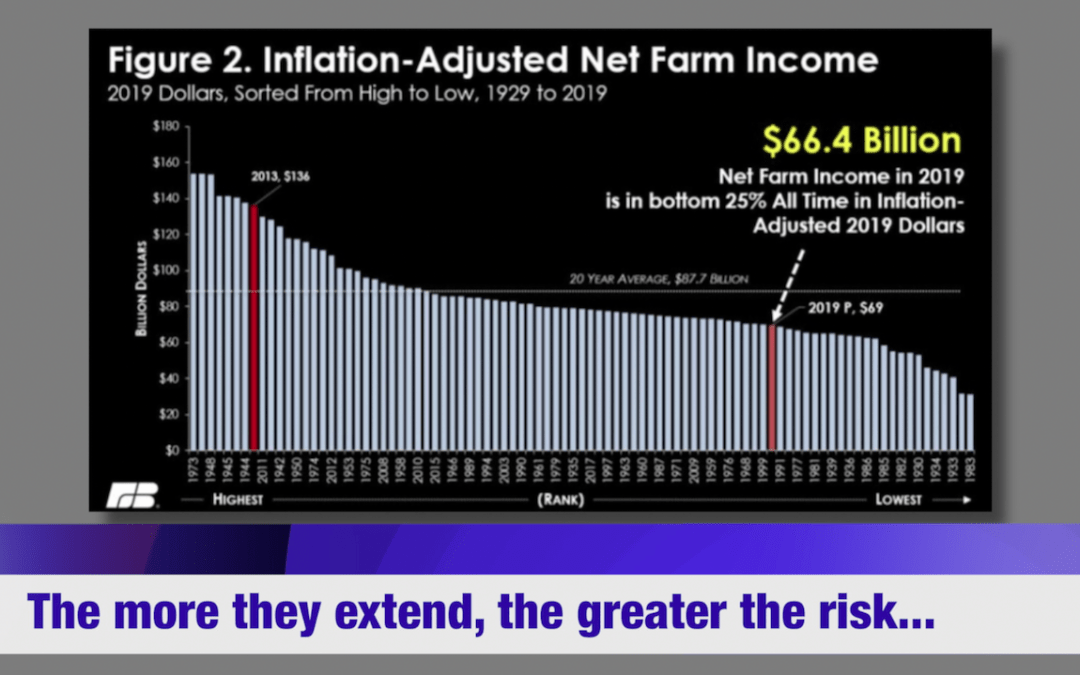

by John P. Reisman | Jan 9, 2020 | Economy

The Trump Trade: Trump created a global trade war, which has put American farmers at risk, pushed many into bankruptcy, disrupted our relationships with allies, and reduced Americas prestige in the world. What’s next?

#News, #Economy, #Finance, #TradeWar

Trump’s China Trade War

by John P. Reisman | Nov 21, 2019 | Economy

Trump’s Trade War is as dizzying as Trump’s Foreign Policy. He claims it’s great while American Farmers are suffering the impacts of Trump’s ineptitude.

#News, #Economy, #TradeWar, Trump

86th Annual BIS Report

by John P. Reisman | Jul 25, 2016 | Economy

Summary: The global economy seems not as bad as rhetoric suggests while historically high risk factors remain unaddressed. Low global growth expectations and high debt narrows the range for policy maneuvering.. There is an urgent policy need for sustainable expansion...

Worldwide Threat Assessment of the US Intelligence Community

by John P. Reisman | Jun 12, 2016 | Economic Security, Economy, Security

by John P. Reisman — last modified Jun 12, 2016 08:25 PM We in the Intelligence Community are committed every day to provide the nuanced, multidisciplinary intelligence that policymakers, warfighters, and domestic law enforcement personnel need to protect American...

84th BIS Report

by John P. Reisman | Mar 4, 2014 | Economy

by John P. Reisman — last modified Nov 24, 2020 05:46 PM Bank for International Settlements, 84th Annual Report, Released 29 June 2014, Basel, Switzerland. The BIS report outlines the general assessment of economic risks and considerations for World Banks and...

Fiscal Cliff? Make it a Fiscal Slide.

by John P. Reisman | Nov 15, 2012 | Economy

The fiscal cliff is a term that describes the retirement of the Bush tax cuts and forced spending cuts baked into the budgeting agenda for the government. To deal with it properly we need to do several things. First, set aside our personal bias and second, set aside our politics. We, America, is…